Who is Required to File Income Tax Returns (ITR) in India?

Filing an Income Tax Return (ITR) is mandatory for various individuals and entities in India, even if they don’t owe any tax. Here’s a summary of who needs to file:

1. Companies:

All companies must file ITR regardless of their profit or loss.

2. Partnership Firms:

All partnership firms must file ITR regardless of their profit or loss.

3. Individuals (Resident of India):

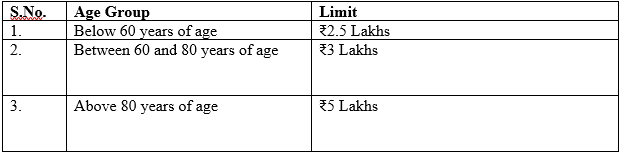

Individuals exceeding the basic exemption limit:

Old Tax Regime:

New Tax Regime:

₹3 Lakhs for all individuals.

4. Individuals claiming a tax refund:

If TDS deductions exceed assessee’s tax liability, assessee must file ITR to claim a refund.

5. Individuals carrying forward losses:

To carry forward losses incurred in a particular year, assessee must file ITR.

6. Individuals with foreign assets:

Residents of India with assets or financial interests in foreign entities are required to file ITR.

7. Individuals with foreign accounts:

Residents of India who are signing authorities in foreign accounts must file ITR.

8. Individuals receiving income from certain trusts/institutions:

Individuals receiving income from trusts, religious institutions, educational institutions, etc., must file ITR.

9. Foreign companies seeking treaty benefits:

Foreign companies seeking tax treaty benefits on transactions in India must file ITR.

10. Individuals exceeding certain financial thresholds:

Individuals who have deposited more than ₹1 Crore in current accounts, ₹50 Lakhs in savings accounts, spent more than ₹2 Lakhs on foreign travel, paid electricity bills exceeding ₹1 Lakh, or had TDS/TCS exceeding ₹25,000 in the previous year.

11. Individuals engaged in business or profession exceeding certain thresholds:

Individuals engaged in business with a turnover exceeding ₹60 Lakhs or in a profession with gross receipts exceeding ₹10 Lakhs.

12. Individuals with Capital Gains:

If assessee have earned capital gains through the sale of assets like property, shares, etc., then assessee must file his/her returns to report these gains.

13. Taxpayers with Deductions Under Section 80:

If assessee have claimed deductions for investments or expenses under sections like 80C (PPF, NSC, life insurance), 80D (health insurance), etc., then assessee must file ITR.

14. HUF (Hindu Undivided Family):

A Hindu Undivided Family needs to file ITR if their total income exceeds the exemption limit.

15. Non-Resident Indians (NRIs):

If assessee are an NRI and have income in India, assessee must file ITR to comply with Indian tax laws.

Consequences of Not Filing ITR

Penalties: Failure to file ITR within the prescribed deadline can result in penalties.

- Non-Tax Audit Cases: Under Section 234F, if assessee fail to file his/her ITR within the due date, a late fee of Rs 5,000 will be applicable.

- So, In context of the above if the annual income of assesse is below Rs. 5,00,000 then the Late Fee would be Rs. 1,000.

- Tax Audit Cases: ₹1,50,000 or 0.5% of Total sales, whichever is lower.

If assessee missed the due date or even not filed Income Tax return upto 31 December u/s 139(4), then there is No chance of filing the Tax Return.

In case assessee miss the deadline prescribed u/s 139(4), then they may file return u/s 139(8A) i.e. ITR U(Updated return) in certain specified cases.

Now Let us Discuss ITR-U (Updated Return)

ITR-U is a mechanism introduced under Section 139(8A) of the Income Tax Act, 1961, that allows taxpayers to update their previously filed Income Tax Returns (ITR). This is crucial because it provides an opportunity to correct errors, omissions, or discrepancies in the original return.

Eligibility for Filing ITR-U

- Within Two Years: ITR-U can be filed within two years from the end of the relevant assessment year.

- For example, for the Assessment Year 2024-25 (relating to the financial year 2023-24), the deadline for filing ITR-U would be March 31, 2026.

NOTE:- In the Union Budget 2025-26, Finance Minister Nirmala Sitharaman introduced key amendments to the Updated Income Tax Return (ITR-U) provisions to enhance voluntary compliance. The deadline for filing an updated return has been extended from 24 months to 48 months from the end of the relevant assessment year, allowing taxpayers more time to rectify errors, disclose unreported income, and comply with tax regulations. This revision aims to improve transparency and reduce litigation by providing a structured mechanism for correcting past tax filings while ensuring timely tax payments.

Reasons for Filing ITR-U

Correcting Errors:

- Incorrectly declared income

- Wrong selection of income heads

- Errors in tax calculations

- Omitted deductions or exemptions

Reporting Missed Income: Including income that was not reported in the original return.

Adjusting Tax Credits: Correcting errors in the calculation of tax credits.