Introduction

GST Returns are forms that businesses registered under the Goods and Services Tax (GST) system must file periodically to report their sales, purchases, output GST, input tax credit (ITC), and other tax-related information. These data helps the governments to track and manage the collection of taxes also the shows the Contributions in the GDP the Country as well as state.

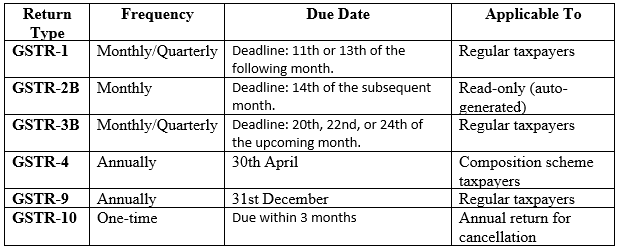

A comprehensive summary of the different GST return formats, their required submission timeframes, and the corresponding compliance duties for businesses.

Types of GST Returns

Within India’s Goods and Services Tax (GST) framework, enrolled firms and taxpayers must submit various categories of GST filings depending on their business type, turnover, and registration type. Below are mentions the types of return which required to be submit or file by the registered persons.

GSTR-1 – Details of Outward Supplies

- Who Files: Registered taxable supplier

- Filing Interval: Monthly submissions required (with quarterly filing options available for taxpayers who qualify under the Quarterly Return Monthly Payment scheme).

Purpose:

- To declare specifics of all external provisions (sales) of merchandise and services.

- Encompasses information such as individual sales invoices, debit memos, and credit memos.

Scheduled Dates:

- Deadline for Monthly Submitters: The eleventh day of the subsequent month.

- For those submitting under the Quarterly Return Monthly Payment system: Due by the 13th of the month following the quarter’s conclusion.

GSTR-2A – Auto-Generated Purchase Return

- Who Files: No manual filing required (auto-generated)

- Frequency: Monthly

Purpose:

- This is a view-only record displaying particulars of incoming acquisitions (purchases) automatically populated from the vendor’s GSTR-1.

- Used for input tax credit (ITC) reconciliation.

GSTR-2B – Static ITC Statement

- Who Files: No manual filing required (auto-generated)

- Periodicity: Monthly (Accessible from the fourteenth of each month).

Purpose:

- Provides a consolidated view of eligible and ineligible Input Tax Credit (ITC).

- Helps businesses claim ITC accurately.

GSTR-3B – A consolidated return summarizing external and internal provisions.

- Who Files: Registered taxpayer

- Frequency: Required on a monthly basis (with quarterly options available for businesses registered under the QRMP program).

Purpose:

- An overview of sales, purchase tax credit claimed, and the tax liability.

- Payment of tax liability.

Due Dates:

- For Monthly Filers: 20th of the Subsequent or Next Month.

- For QRMPS Filers: 22 or 24 of the Subsequent or Next Month of Quarter End.

GSTR-4 – Tax return submission required for businesses operating within the Composition Scheme framework.

- Who Must File: Taxpayers enrolled in the Composition Scheme.

- Frequency: Annually

Purpose:

- An overview detailing aggregate business revenue and composition scheme tax liability.

- Limited reporting requirements compared to regular taxpayers.

Due Date: April 30th of the subsequent fiscal year.

GSTR-5 – Submitted by Non – Residents.

- Who Files: Non-resident taxpayers

- Frequency: Monthly

Purpose:

- Reports sales and purchases made in India by non-resident taxpayers.

- Payment of tax liability.

Due Date: 20th of the following month

GSTR-5A – Return for OIDAR Services

- Who Files: Online Information and Database Access or Retrieval (OIDAR) service providers outside India who provide services in india.

- Frequency: Monthly

Purpose:

- Particulars of services rendered to unregistered individuals within India.

- Payment of tax liability.

Due Date: 20th of the following month

GSTR-6 – Filing for Purchase Tax Credit Distribution Units (ISD).

- Who Files: Input Service Distributors

- Frequency: Monthly

Purpose:

- Allocation of purchase tax credit (ITC) across operational units.

- Reports details of ITC received and distributed to their associates

Due Date: 13th of the following month

GSTR-7 – Return for TDS Deductors

- Who Files: Tax Deductors (like government departments)

- Frequency: Monthly

Purpose:

- Reports details of Tax Deducted at Source (TDS) under GST.

- TDS certificate is auto-generated after filing.

Due Date: 10th of the following month

GSTR-8 – Return for E-Commerce Operators

- Who Files: E-Commerce Operators

- Frequency: Monthly

Purpose:

- Reports details of supplies made through the E – Commerce platform.

- Tax collected at source (TCS) under GST on monthly basis.

Due Date: 10th of the following month

GSTR-9 – Annual Return

- Who Files: Regular taxpayers

- Frequency: Annually

Purpose:

- A holistic summary of all GST filings submitted during the fiscal year.

- Includes data on sales, acquisitions, purchase tax credit (ITC), and tax liabilities.

Due Date: 31st December of the subsequent or Next financial year.

GSTR-9A – Yearly return for taxpayers under the Composition Scheme.

- Who Files: Composition Scheme taxpayers (Optional)

- Frequency: Annually

Purpose:

- Overview of all returns submitted under the Composition Scheme throughout the financial year.

Due Date: 31st December of the subsequent financial year.

GSTR-9C – Reconciliation Statement

- Who Files: Taxpayers whose total turnover exceeds ₹5 crore.

- Frequency: Annually

Purpose:

- Reconciliation of GSTR-9 with audited financial statements of relevant financial year.

- Certification by a Chartered Accountant (CA) is required.

Due Date: 31st December of the subsequent financial year.

GSTR-10 – Annual Return

- Who Must File: Entities whose GST registration status has been terminated or voluntarily relinquished.

- Frequency: Once

Purpose:

- Reports details of closing stock and final tax liability.

- Due Date: Must be completed within a three-month timeframe following the cancellation notification or official order.

GSTR-11 – Return for UIN Holders

- Who Must File: Individuals or entities holding a Unique Identification Number (UIN).

- Frequency: Monthly

Purpose:

- Requests a refund for taxes paid on incoming supplies.

Due Date: 28th of the following month

Common GST Filing Timelines Overview

Key Notes:

✅ ₹50 per day penalty is levied for late filing (₹20 for NIL returns).

✅ Delayed tax payments incur an interest charge of 18% per annum.

✅ Taxpayers enrolled in the Quarterly Return Monthly Payment (QRMP) plan are required to submit GSTR-1 and GSTR-3B on a quarterly basis yet remit taxes every month.

Conclusion:

Submitting GST returns correctly and promptly is essential to ensure compliance and prevent penalties. Businesses must stay on top of return filing deadlines and ensure all details are correctly reported to prevent tax issues.

If you require assistance on filing any specific GST return, Manthan Experts can be your trusted advisor. Contact them at info@manthanexperts.com.to discuss your specific needs and explore how their expertise can benefit your business.