Tax Audit in India: Rules, Forms, Due Dates & Penalties

Manthan Experts

July 30, 2025

Introduction to Tax Audit in India

Tax Audit is conducted as per Section 44AB of the Income Tax Act, 1961 and is mandatory For all businesses and professionals having turnover more than the prescribed limits.

Purpose and Importance of Tax Audit

1. Purpose of Tax Audit

- Ensures Accuracy in Financial Statements – Verifies the correctness of income, expenses and tax computations.

- Prevents Tax Evasion – It brings financial discipline and ensures tax law compliant books.

- Simplifies Tax Assessment – Helps the Income Tax Department process tax returns efficiently.

- Verifies Deductions and Exemptions – Ensures correct claims for exemptions, and allowances, deductions.

- Encourages Proper Record-Keeping – Mandates taxpayers to maintain proper books of accounts.

2. Importance of Tax Audit

- Reduces Chances of Scrutiny – A properly conducted tax audit minimizes the risk of an Income Tax Department investigation.

- Ensures Compliance with Tax Laws – Avoids penalties and legal complications By following tax regulations.

- Helps in Claiming Legitimate Deductions – Assists taxpayers in claiming Deductions like depreciation, business expenses, and other exemptions.

- Improves Business Credibility – An audited financial statement enhances acompany and credibility with banks, investors, and stakeholders.

- Identifies Financial Weaknesses – Provides insights into financial discrepancies, helping businesses improve internal controls.

Who is Required to Conduct a Tax Audit?

As per Income Tax act following individuals orentities are required to conduct a tax audit:

1. Businesses

A tax audit is mandatory :

- Turnover > ₹1 crore in a financial year.

- If total receipts and payments in cash less then 5%

limit is increased to ₹10 crores per annum.

2. Professionals

- Turnover > ₹50 lakh per annum.

3. Presumptive Taxation Scheme

If taxpayer declare profits which are lower than the required percentage under:

- Section 44AD (Businesses) –at least 8% (or 6% for digital transactions) of turnover.

- Section 44ADA (Professionals) – Minimum 50% of gross receipts.

- Section 44AE (Transporters) – Profit should be declared as per the number of vehicles owned.

4. Special Cases

- Companies and LLPs may require a statutory audit under the Companies Act, but a tax audit is separate.

Tax Audit Process

it is a systematic review of books of accounts and compliances. The keysteps include:

1. Appointment of Auditor

- A Chartered Accountant (CA) must be appointed in order to conduct the tax audit.

2. Verification of Financial Statements

- Examination of Balance Sheet, Profit and Loss Account, Cash Flow Statements and Books of Accounts.

3. Checking Compliance with Tax Laws

- All statutory compliances which includes GST, TDS, TCS, EPF, ESIC etc

4. Preparation and Submission of Tax Audit Report

- The Tax Audit Report (Form 3CA/3CB & 3CD) which is issued by the Auditors is required to file electronically on the Income Tax e-filing portal.

Tax Audit Report and Forms

A tax audit report is prepared and submitted electronically by a Chartered Accountant. The audit report is furnished using prescribed forms, depending on the nature of the business or profession.

1. Forms for Tax Audit Report

There are two primary forms used for tax audit reports:

(i) Form 3CA and Form 3CD

- Applicable to those professionals or Businesses who already required to conduct an audit under any other law (like statutory audit).

Structure:

- Form 3CA – it is report that certifies audit was conducted under another law also.

- Form 3CD – A detailed statement of the findings of the audit.

(ii) Form 3CB and Form 3CD

- Applied on those professional or businesses who are not obliged to undergo audit under other law.

Structure:

- Form 3CB – A detailed report stating that the audit was conducted as per the Income Tax Act.

- Form 3CD – A detailed statement of observations and findings during the audit.

2. Important Particulars of 3CD Form

Form 3CD is a comprehensive statement covering:

- Nature of business/profession

- Financial particulars (turnover, gross receipts, profit etc.)

- Details of loans, debts, and payments

- Related party transactions

- Deductions and allowances claimed

- GST details

- Tax deducted at source (TDS) compliance

Due Date for Tax Audit

The Report for tax audit must be filed one month prior to the Income tax return filing due date.

- For businesses and professionals requiring audit – 30th September of the assessment year.

- For taxpayers on whose Transfer Pricing rules are applicable – 31st October of the assessment year.

Penalties for Non-Compliance

Below are the common penalties for failing to comply with tax audit requirements:

India (Under Income Tax Act, 1961) Following penalties apply If a taxpayer fails to conduct a tax audit

1. Penalty under Section 271B

The penalty is the lower of:

- 0.5% of total turnover or

- ₹1,50,000 (whichever is lower).

Exception: No penalty if the taxpayer proves reasonable cause (e.g., natural calamity, illness etc.).

2. Penalty for default in Tax Audit Report

- Late filing of the audit report (Form 3CA/3CB and Form 3CD) can result in a penalty under Section 271B.

3. Additional Consequences

- Loss of deductions and exemptions in some cases.

- Higher scrutiny by tax authorities.

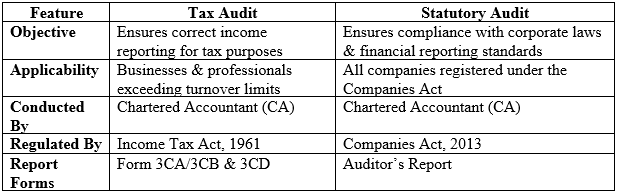

Tax Audit vs. Statutory Audit

Conclusion

A Tax Audit is not only a legal requirement but it also prevents tax evasion, brings financial transparency and help businesses in maintaining correct records. Therefore, Taxpayers must adhere to the prescribed regulations and deadlines to avoid penalties and legal issues.

If you require assistance on Audit and Assurance Services, Manthan Experts can be your Trusted advisor. Contact them at info@manthanexperts.com to discuss your specific needs and explore How their expertise can benefit your business.