Old Regime and New Tax Regime: Which One is Better?

From F.Y. 2020-21 the tax structure for individuals in India is divided into two regimes: The Old Tax Regime and The New Tax Regime. These regimes offer different tax rates, exemptions, and deductions, allowing individuals to choose the one that suits them best. Below is an elaboration on both tax regimes and their respective tax slabs:

Old Tax Regime (with exemptions and deductions)

The Old Tax Regime allows taxpayers to avail of various exemptions and deductions under different sections like Section 80C (for investments), Section 80D (for insurance premiums), and other provisions. This regime is beneficial for individuals who have significant tax-saving investments.

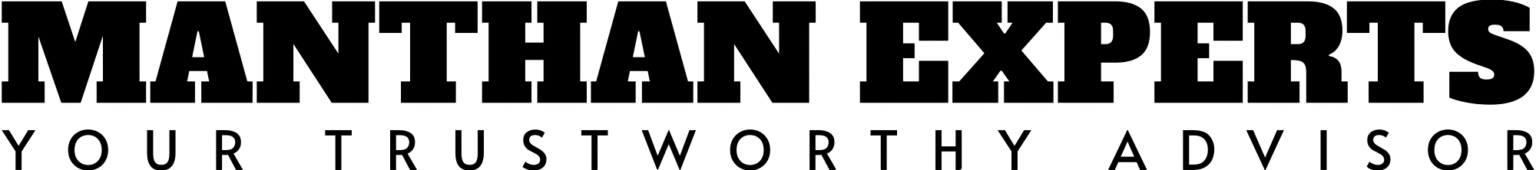

Tax Slabs under the Old Tax Regime for FY 2024-25 (Assessment Year 2025-26)

Key Features of the Old Regime

Exemptions:

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Special allowances like children education allowance, Medical allowance and Telephone allowance.

Deductions:

- Section 80C (up to ₹1.5 lakh) for investments in PPF, EPF, NSC, etc.

- Section 80D for premiums on health insurance.

- Section 24(b) for home loan interest deduction (up to ₹2 lakh).

Tax Rebate: The benefit of ₹12,500 (for individuals under ₹5 lakh income) is provided under section 87A for eligible taxpayers.

New Tax Regime (without exemptions and deductions)

The New Tax Regime was introduced in F.Y. 2020-21 to offers lower tax rates but does not allow taxpayers to claim deductions or exemptions.

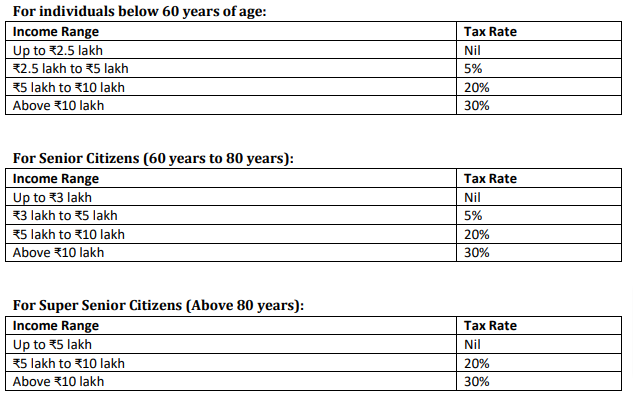

Tax Slabs under the New Tax Regime for FY 2024-25 (Assessment Year 2025-26)

For individuals below 60 years of age:

For Senior Citizens (60 years to 80 years): The tax slabs under the new regime are the same as for individuals below 60 years of age.

For Super Senior Citizens (Above 80 years): The tax slabs are also the same as for individuals below 60 years of age.

Key Features of the New Regime

Lower Tax Rates: The New Regime offers reduced tax rates on income, but this comes at the cost of no deductions or exemptions.

No Deductions or Exemptions:

- No claim for deductions under sections from 80C to 80U, 24(b), etc.

- No exemptions for HRA, LTA, or other similar allowances.

Deductions allowed under New Tax Regime:

- Employer’s contribution to the National Pension Scheme (NPS) is allowable u/s 80CCD(1B).

- Agricultural income remains exempt as per Section 10(1).

Tax Rebate under Section 87A: The tax rebate of ₹25,000 (under ₹7 lakh income) is available under the new tax regime.

Note:- If Assesse want know more about deductions please visit to Income tax official website.

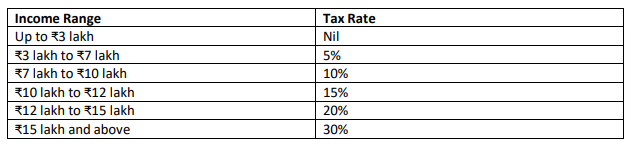

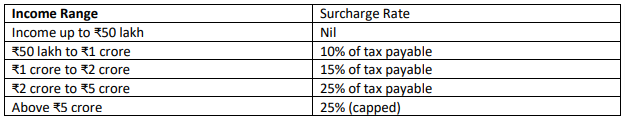

Now if we discuss about Surcharge Under Old tax regime

Surcharge is applied on the total income tax liability (excluding health and education cess) based on the following income slabs:

Cess: After applying the surcharge, a 4% health and education cess is added.

Under New tax regime

Under the new regime, the surcharge rates are similar but with a key difference for higher incomes:

Cess: Similar to old regime, a 4% health and education cess is applied after surcharge.

Note: In the new tax regime, the maximum surcharge rate has been capped at 25%, even for incomes exceeding ₹5 crore, as opposed to 37% in old regime.

For FY 2024-25 (AY 2025-26), the new tax regime continues to be the default tax regime for individual and HUF taxpayers. If assessee wants to opt for the old tax regime, then they are required to file Form 10IEA.

Which Tax Regime Should You Choose?

If assesses have significant deductions (e.g., PPF, insurance premiums, home loan interest), the Old Tax Regime might be beneficial, as it reduces taxable income.

If assesses do not have many deductions and exemptions, the New Tax Regime with its lower tax rates might be more advantageous.

Both regimes are available to individuals and HUF, and they can switch between them every financial year (with some restrictions for salaried taxpayers on employer’s provided benefits). It is important to assess individual’s financial situation and tax-saving options to choose the best tax regime.

If you require assistance on filing Income Tax Return, Manthan Experts can be your trusted advisor. Contact them at info@manthanexperts.com.to discuss your specific needs and explore how their expertise can benefit your business.