Introduction

When it comes to managing income tax in India, taxpayers often find themselves confused about the concepts of marginal relief and Section 87A rebate. Both provisions aim to reduce the overall tax burden, but they apply under different circumstances and benefit different types of taxpayers.

Understanding the difference between marginal relief and rebate under Section 87A is essential for effective tax planning and maximizing your tax savings. In this detailed guide, we’ll break down how these two benefits work, their eligibility criteria, calculation methods, and how they impact your final tax liability.

By the end of this article, you’ll have a clear understanding of:

✔️ What marginal relief and Section 87A rebate are

✔️ How to calculate them

✔️ Who is eligible for these benefits

✔️ How to maximize your tax savings using them

What is Marginal Relief Under Income Tax?

Marginal relief is a provision under the Income Tax Act that provides relief to taxpayers whose taxable income slightly exceeds the threshold for a higher tax slab or surcharge. The purpose of marginal relief is to ensure that the additional tax liability due to crossing the income threshold is limited to the amount by which the income exceeds the threshold.

Why is Marginal Relief Important?

When a taxpayer’s income crosses a specific limit, they may face a higher tax rate due to moving into a higher tax slab. Marginal relief ensures that the increased tax liability is not higher than the actual income increase over the threshold.

Example of Marginal Relief Calculation

Mr. Arjun has a total taxable income of ₹51,00,000 for FY 2024-25. According to the Income Tax Act, a 10% surcharge applies if the income exceeds ₹50,00,000.

Step-by-Step Calculation:

1. Taxable Income = ₹51,00,000

2. Base Tax Calculation

- Income up to ₹50,00,000 = ₹13,12,500 (as per slab rates)

- Additional income above ₹50,00,000 = ₹1,00,000

- Tax on ₹1,00,000 at 30% = ₹30,000

3. Surcharge Calculation Without Marginal Relief

- Total tax without surcharge = ₹13,12,500 + ₹30,000 = ₹13,42,500

- Surcharge at 10% on ₹13,42,500 = ₹1,34,250

- Total tax with surcharge = ₹13,42,500 + ₹1,34,250 = ₹14,76,750

4. Apply Marginal Relief

The surcharge is ₹1,34,250, which is higher than the excess income of ₹1,00,000.

Therefore, marginal relief will reduce the surcharge to the excess income amount of ₹1,00,000.

Final Tax Payable After Marginal Relief:

- Base tax = ₹13,42,500

- Reduced surcharge (due to marginal relief) = ₹1,00,000

- Total tax payable = ₹13,42,500 + ₹1,00,000 = ₹14,42,500

How to Calculate Marginal Relief

- Calculate the total income exceeding the threshold.

- Compute the tax liability under the higher slab.

- Marginal relief will be the difference between the increased tax liability and the excess income above the threshold.

What is a Rebate Under Section 87A?

Rebate under Section 87A is a tax benefit available to resident individuals whose total taxable income does not exceed a specified limit. It directly reduces the tax payable, effectively lowering the tax liability to zero if the income is within the eligible limit.

Why is Section 87A Rebate Important?

Section 87A rebate is designed to reduce the tax burden for middle- and lower-income individuals by allowing them to offset a portion of their income tax liability.

Rebate Limits Under Section 87A

For FY 2024-25 (AY 2025-26):

- Under the new tax regime – Maximum rebate of ₹25,000 for income up to ₹7,00,000

- Under the old tax regime – Maximum rebate of ₹12,500 for income up to ₹5,00,000

Example of Section 87A Rebate Calculation

Let’s say your taxable income is ₹6,90,000 under the new tax regime:

- Total tax liability before rebate = ₹25,000

- Eligible rebate under Section 87A = ₹25,000

- Final tax payable = ₹25,000 – ₹25,000 = ₹0

Eligibility Criteria for Section 87A Rebate

✔️ You must be a resident individual.

✔️ Your total taxable income should not exceed ₹7 lakh under the new regime or ₹5 lakh under the old regime.

✔️ The rebate applies to the total tax payable before adding cess (health and education).

✔️ Non-resident individuals (NRIs) are not eligible for this rebate.

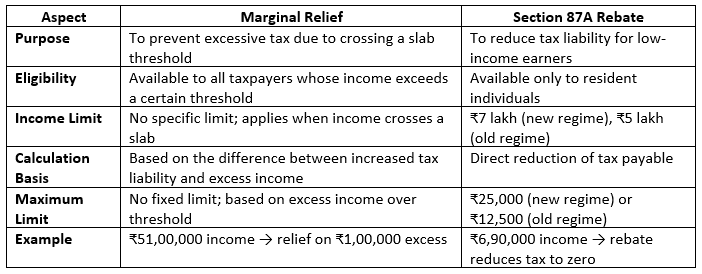

Key Differences Between Marginal Relief and Section 87A Rebate

While both marginal relief and Section 87A rebate help reduce tax liability, they serve different purposes and apply under different conditions.

How to Claim Marginal Relief and Section 87A Rebate

Steps to Claim Marginal Relief:

- Calculate your total taxable income.

- Identify the income threshold for higher tax slabs.

- Compute the tax liability under the higher slab.

- Marginal relief will be the difference between increased tax liability and the excess income over the threshold.

Steps to Claim Section 87A Rebate:

- File your income tax return (ITR).

- Report your total taxable income after deductions.

- If your income is within the eligible limit, the rebate will be automatically applied.

- The rebate will appear in the final tax calculation.

Practical Scenarios

Scenario 1: Marginal Relief

- Total taxable income = ₹51,00,000

- Threshold for higher slab = ₹50,00,000

- Tax on ₹51,00,000 = ₹14,76,750

- Marginal relief reduces the tax burden to ₹14,42,500

Scenario 2: Section 87A Rebate

- Total taxable income = ₹6,90,000

- Tax payable = ₹25,000

- Eligible for rebate under Section 87A = ₹25,000

- Final tax payable = ₹0

Which One Should You Claim?

- If your income slightly exceeds the tax slab threshold, you can benefit from marginal relief.

- If your income is below the rebate limit under Section 87A, you can reduce your tax liability to zero.

- You cannot claim both benefits simultaneously — it depends on your income level and the tax regime you select.

Tips to Maximize Your Tax Savings

- ✅ Choose the tax regime carefully — the new regime offers higher rebate limits, but fewer deductions.

- ✅ If your income slightly exceeds ₹7 lakh under the new regime or ₹5 lakh under the old regime, marginal relief could save you more tax.

- ✅ Ensure that you claim all eligible deductions (under Section 80C, 80D, etc.) before calculating your final tax liability.

Conclusion

Understanding the difference between marginal relief and Section 87A rebate can help you plan your taxes more effectively. While marginal relief prevents excessive tax due to crossing a slab, Section 87A rebate helps low-income earners eliminate their tax liability altogether. Consulting a tax expert can help you decide which benefit applies to your situation and maximize your tax savings.

FAQs

1. Can I claim both marginal relief and Section 87A rebate together?

➡️ No, you can only claim one benefit based on your total taxable income and tax liability.

2. Does marginal relief apply under both old and new regimes?

➡️ Yes, marginal relief applies under both tax regimes.

3. Is Section 87A rebate available to NRIs?

➡️ No, Section 87A rebate is only available to resident individuals.

If you require assistance with Income Tax compliance, Manthan Experts can be your trusted advisor. Contact them at info@manthanexperts.com.to discuss your specific needs and explore how their expertise can benefit your business.